Interview with Dmitrii Barbasura, Founderand CEO of Salt Edge Inc. Be great together powered by Tekwill Section

Hello,Dima. Help me solve a difficult task. I want to make the interview clear to all my audience. It’s difficult. We agreed to talk about Open Banking. But! Although I studied at the faculty of “Finance and Banking”. I worked for five years in a bank. It’s hard for me to understand what Salt Edge deals with. Be indulgent to me as I’ll ask to explain everything in lay terms.

Come on. Not in lay terms, but in a simple diagram.

Thanks. Then make a short introduction about Salt Edge and let’s then deal with Open Banking.

Salt Edge Inc. is a Canadian company established on 31 December 2013. Now its subsidiary, Salt Edge SRL, carries out its activity in Moldova. We are working in an area that everyone usually calls Fin Tech, although, as you understand, Fin Tech has more than a dozen of service lines or maybe even more than one hundred. We are specialized in services related to Open Banking. Now our service provides access to more than 3,800banks in 70 countries.

So far, everything is clear. Now the diagram and the explanation to it.

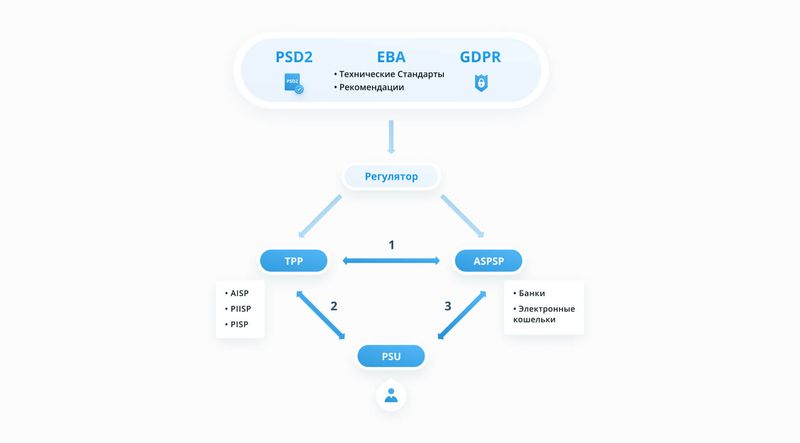

The diagram has a minimum number of abbreviations. But I’ll have to explain them all, otherwise, if at least one link falls out, everything will become unclear again.

Then let’s begin from above. PSD2, EBA and GDPR. The main thing is that not all readers “scram” after these first three abbreviations.

Everything is very simple here. PSD2 is the second European Payment Services Directive. It obliges every bank in Europe to open a safe channel for third-party financial service providers so that they can access information about the customer’s account status or initiate a payment on its own behalf.

Here is an example, as I understand, if I’m wrong, correct me. This means that a kind of Fin Tech start-up appeared and tells me: “Pavel, connect you to us and you’ll make very conveniently all payments, more conveniently than with a bank. We’ll provide you with a service of analysing your expenses. Moreover, we’ll also credit you. All this in a user-friendly and clear interface”. I tell them “OK”, and from that moment is the bank obliged to provide this company with access to dispose of my account?

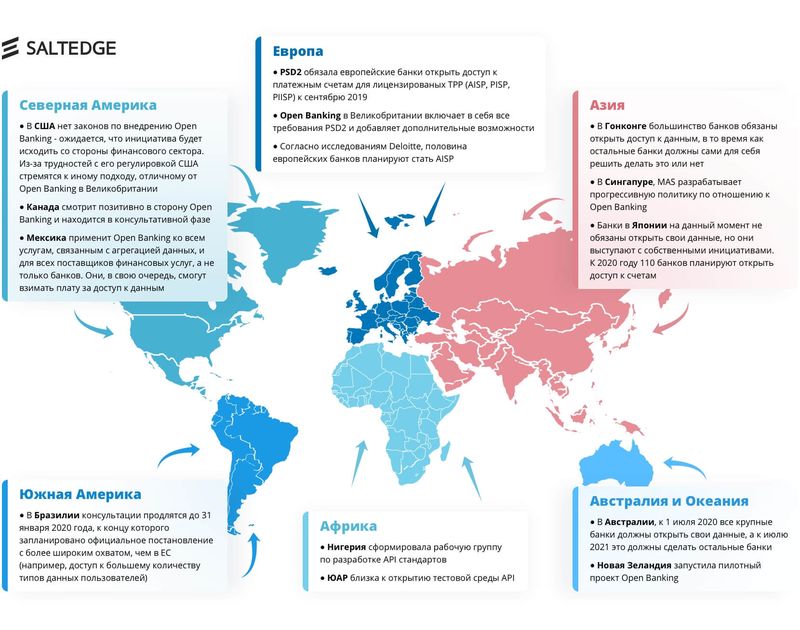

Yes, it is, in Europe and in another 30 countries of the world. Not in Moldova yet, but it’s only a matter of time before we join PSD2.

As I understand, the decision has been made to make the financial market democratic and give consumers more freedom in choosing a service provider, rather than a clumsy bank?

I’ll not evaluate the “nimbleness” of the bank. But, yes, that's so. Let’s move on. I think that the following two abbreviations, after their interpretation, will not need any explanation. EBA is the European Banking Authority that provides the implementation of PSD2. And GDPR is...

This is a data protection regulation. Everything is really clear here.

Let’s go down through the diagram. The regulator establishes relationships between the three main players of the Open Banking processes. I’ll briefly describe each of them.

Let's begin with you or your business. Both of you are PSU, Payment Services User. That is, you are customers of payment services. You provide access to your account to the service provider, and after that it will provide you with information about your accounts and (or) will credit or debit money to/from the accounts. Previously, only your bank did this, but now it can be done by Fin Tech, whose services are more interesting to you than the services of the bank where you have an account.

I’m a PSU, a Payment Services User. Ok, I put up with this.

Let’s go to TPP, Third Party Provider. This is an authorized service provider that will work with your account. There are several types of such provides. Some of them may have only access to the account for information purpose. For example, you’ll receive diagrams of your monthly expenses to control your payments. Another one will be able to write off or credit money from/to your account. They are indicated on the diagram by three more abbreviations, but I’ll not stuff your head with them.

So, the second player of the Open Banking processes is an authorized financial institution, which, with my permission, works with my account either for information purposes or to make payments, isn’t it?

Yes. Let’s go to the third player. This is Account Servicing Payment Service Provider (ASPSP) - banks and electronic wallets that provide payment bills to the customer. ASPSPs are required to provide interfaces that allow, subject to the consent of the customer, making payments initiated by third-party providers, and are also required to provide information on account status and history of transactions.

In general, everything is clear. Where is Salt Edge here?

Without going into details, Salt Edge provides two main types of services. We help banks (ASPSPs) to build a safe and reliable channel to meet the PSD2 requirements. In fact, we “open” the bank for access by other financial entities to the accounts of bank customers. Naturally, security is extremely important here, but, besides it, there are many other issues in which the IT service of the bank could not always have the necessary powers. And the second type of service - we put in place communication channels independently between all Open Banking players.

In the second part, let me repeat it for myself. Let’s suppose that I’m not me, but an authorized financial entity that wants to provide services to customers of banks in 70 countries. I connect to 3,830 banks through Salt Edge, conduct a spectacular advertising campaign to attract customers and, voila, the whole world is in my pocket?

In fact, the competition in the Fin Tech market is so high that your plan looks like an absolute fairy tale. But it’s not fiction. Technically, this will happen. You’ll get the opportunity to provide services to customers in almost 4,000 banks in the world.

But not in Moldova?

Not even in the USA yet. But already 30 countries have approved Open Banking. To avoid listing all of them, here is the second diagram - the map of presence of Open Banking around the world.

Thanks. Then here is the last question, for those who will read to this point and get through all the abbreviations. Salt Edge will be the general partner of the big Fin Tech conference in Moldova in late February. Tell me about this in details…

I think this will be the main Fin Tech event of the year. The organizer is Tekwill. Regulators, banks, start-ups and investors from both Moldova and abroad are invited. The participants and speakers will come from Great Britain, Japan, Russia, Romania, Czech Republic, Poland and Ukraine. This will be an important step in the development of the Fin Tech ecosystem in Moldova. And a real opportunity to “open” Fin Tech of Moldova to the world and prove that we have the most advanced solutions in this field.

P.S. In this interview, you can definitely do without a commercial break. And I just once again announce the conference whose co-organizersare Salt Edge and Tekwill